A USDA Home Loan from the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, is a mortgage loan offered to rural property owners by the United States Department of Agriculture. USDA Loans offer 100% financing to qualified buyers, and allow for all closing costs to be either paid for by the seller or financed into the loan.

Income Eligibility Calculator: Please visit the USDA website

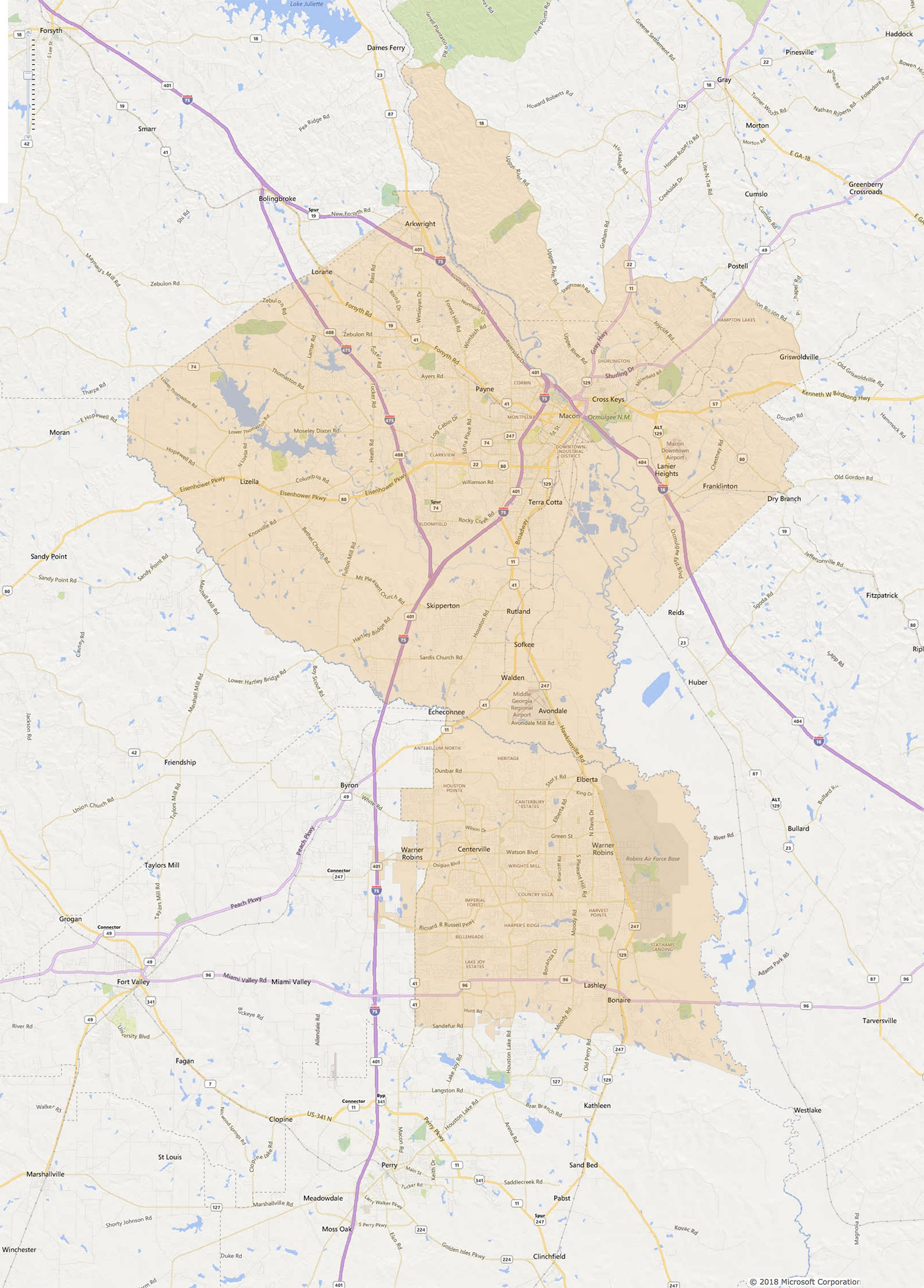

Map Legend:

Please click on the map to enlarge. Homes located outside of the shaded yellow area might be eligible for the USDA Loan Program. Not all homes listed below will qualify for the loan program. Eligibility depends on household income and the amount of people living in the home. Please refer to the Eligibility Calculator to see if a home qualifies or call us at (478) 287-2004.

If you have any question about the USDA loan program, please give me a call at (478) 714-6939. I will be happy to connect you with an approved lender who can assist you with a loan.